- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

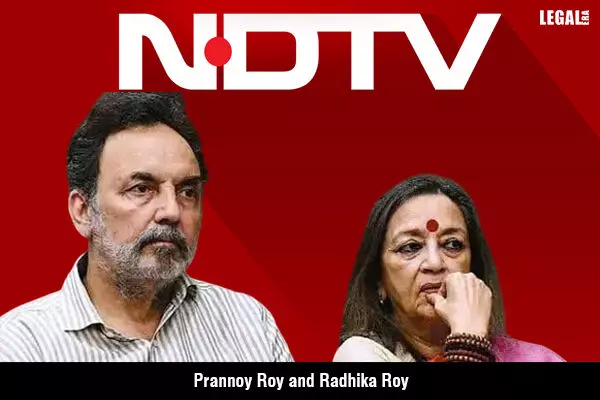

Delhi High Court Quashes Second Reopening Of AY 2009–10 Against Radhika & Prannoy Roy; Holds Repeated IT Reassessment ‘Arbitrary’ And Harassment

Delhi High Court Quashes Second Reopening Of AY 2009–10 Against Radhika & Prannoy Roy; Holds Repeated IT Reassessment ‘Arbitrary’ And Harassment

Introduction

The Delhi High Court quashed repeated reassessment proceedings initiated by the Income Tax Department against NDTV founders Radhika Roy and Prannoy Roy for Assessment Year 2009–10, holding that reopening the assessment for the same transaction amounted to “unnecessary harassment.” The Court observed that such repeated action strikes at the root of a fair adjudicatory process and creates unpredictability and uncertainty in tax administration.

Factual Background

Radhika Roy and Prannoy Roy were each 50% shareholders and directors of RRPR Holding Pvt. Ltd. For Assessment Year 2009–10, they declared income of approximately Rs. 1.66 crore, which was initially accepted by the Income Tax Department.

In 2011, the Department reopened the assessment under Sections 147/148 of the Income Tax Act, 1961, raising questions regarding transactions involving NDTV shares and interest-free loans received from RRPR Holding Pvt. Ltd. During the reassessment proceedings, the Assessing Officer summoned the company’s books of accounts, examined the loan transactions in detail, and sought explanations from the assessees. The reassessment was completed in March 2013 without making any additions in respect of the interest-free loans.

Nearly three years thereafter, the Department issued fresh reassessment notices for the same Assessment Year, proposing to tax notional interest on the very same interest-free loans by invoking a different provision of the Act.

Procedural Background

Aggrieved by the second reopening of their assessment for the same year and on the same transaction, the petitioners approached the Delhi High Court under Article 226 of the Constitution. They challenged the validity of the reassessment notices, contending that the action amounted to a mere change of opinion and was barred by limitation.

Senior Advocate Sachit Jolly, appearing for the petitioners, argued that the issue had already been examined during the earlier reassessment proceedings and that reopening the matter again was legally impermissible.

Issues

1. Whether the Income Tax Department could reopen reassessment proceedings for the same Assessment Year and transaction after having examined the issue in earlier reassessment proceedings.

2. Whether the second reopening amounted to a mere change of opinion.

3. Whether invocation of the extended limitation period on the ground of alleged non-disclosure of material facts was justified.

4. Whether the repeated reassessment violated the petitioners’ constitutional rights under Articles 14, 19(1)(g), and 300A.

Contentions of the Parties

The petitioners contended that the reassessment proceedings initiated in 2011 had thoroughly examined the interest-free loan transactions. The Assessing Officer had scrutinised the books of accounts and completed the reassessment in 2013 without making any addition on that issue. It was argued that reopening the same assessment year again on the same transaction, albeit under a different provision, constituted a change of opinion, which is impermissible under settled law.

The petitioners further submitted that all relevant material, including audited accounts and details of the loans, had been fully disclosed during the earlier proceedings. Hence, the Department could not invoke the extended six-year limitation period on the ground of alleged failure to disclose material facts.

The Income Tax Department contended that the reassessment was valid and sought to justify invocation of the extended limitation period.

Reasoning and Analysis

The High Court observed that the earlier reassessment proceedings had specifically examined the interest-free loan transactions. The Assessing Officer had summoned records, sought explanations, and consciously chosen not to make any addition on that issue. In such circumstances, reopening the assessment again for the same transaction was impermissible.

The Court held that the Department could not “trigger the proceedings under Section 147/148 all over again” merely because it wished to view the same transaction from a different angle. Such action, the Court observed, amounted to a change of opinion and was contrary to established principles governing reassessment.

On the question of limitation, the Court found that the audited financial statements and full details of the transactions were already on record during the earlier reassessment. Therefore, it could not be said that the petitioners had failed to disclose true and material facts. The invocation of the extended limitation period was described as “absolutely baseless” and rendering the reassessment fundamentally without jurisdiction.

The Court further observed that subjecting the petitioners to reassessment proceedings a second time for the selfsame transaction was arbitrary and violative of their constitutional rights under Articles 14, 19(1)(g), and 300A of the Constitution of India. Such repeated reopening, the Bench remarked, hit the very root of a fair adjudicatory process and created unpredictability and uncertainty, if not anarchy, in tax administration.

Decision

The Delhi High Court quashed the reassessment notices issued against Radhika Roy and Prannoy Roy for Assessment Year 2009–10. The Court imposed token costs of Rs.1 lakh each on the Income Tax Department, payable to the petitioners. The writ petitions were accordingly allowed.