- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

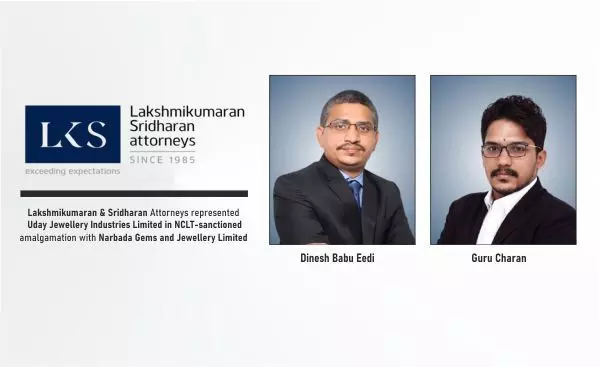

Lakshmikumaran & Sridharan Attorneys Represented Uday Jewellery Industries Limited In NCLT-Sanctioned Amalgamation With Narbada Gems And Jewellery Limited

Lakshmikumaran & Sridharan Attorneys represented Uday Jewellery Industries Limited in NCLT-sanctioned amalgamation with Narbada Gems and Jewellery Limited

The leading law firm in India, Lakshmikumaran & Sridharan, Attorneys (“LKS”) represented Narbada Gems and Jewellery Limited (“Transferor Company” / “Petitioner No. 1”) and Uday Jewellery Industries Limited (“Transferee Company” / “Petitioner No. 2”), both public limited companies listed on the BSE, before the National Company Law Tribunal, Hyderabad Bench (“Hon’ble NCLT”), in connection with the sanction of a Composite Scheme of Arrangement for Amalgamation under Sections 230 to 232 of the Companies Act, 2013.

By its order dated 21 January 2026, the Hon’ble NCLT sanctioned the amalgamation of the Petitioner Companies, with 01 April 2024 as the appointed date. Upon the Scheme becoming effective, all assets, properties, rights, liabilities, obligations, and undertakings of the Transferor Company stand transferred to and vested in the Transferee Company, without any further act or deed, in accordance with the sanctioned Scheme.

The amalgamation represents a strategic consolidation of group entities engaged in the jewellery manufacturing and trading business, aimed at achieving operational efficiencies, streamlined governance, enhanced financial strength, and long‑term value creation for shareholders and other stakeholders.

The Corporate and M&A team at LKS acted as the counsel on record for the Petitioner Companies and represented them throughout the proceedings before the Hon’ble NCLT. The firm advised on the structuring of the Scheme, statutory and regulatory compliances, facilitated shareholder approvals, and successfully addressed observations raised by the Regional Director, the Official Liquidator, and the Income Tax Department.

Notably, the entire approval process was completed within a period of less than six months, underscoring the firm’s efficiency and commitment to timely execution.

The firm appeared before the Hon’ble NCLT through Mr. Dinesh Babu Eedi (Advocate) and Mr. Guru Charan (Advocate).

Click to know more about Lakshmikumaran & Sridharan Attorneys

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.