- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Supreme Court Upholds Arbitral Award Holding Husband Jointly Liable For Wife’s Stock Market Losses

Supreme Court Upholds Arbitral Award Holding Husband Jointly Liable For Wife’s Stock Market Losses

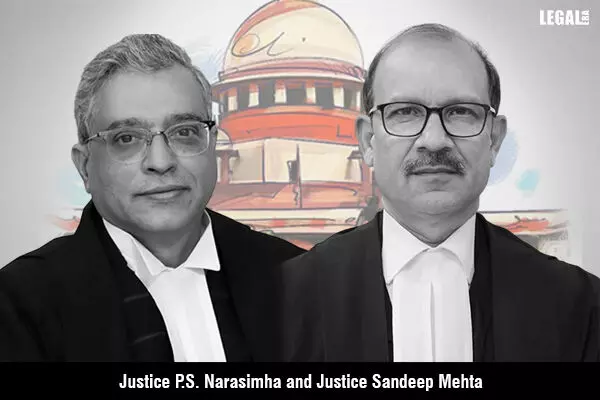

In a significant ruling, the Supreme Court has held that an oral contract establishing joint and several liability falls within the scope of an arbitration clause. A Bench comprising Justices P.S. Narasimha and Sandeep Mehta upheld an arbitral award against a husband, finding him jointly liable for a debit balance in his wife's stock trading account. The Court ruled that the arbitral tribunal had jurisdiction under Bye-law 248(a) of the Bombay Stock Exchange (BSE) Bye-laws, 1957, dismissing the husband's contention that his liability arose from a private arrangement outside the purview of arbitration.

The case arose from financial dealings between a couple who had opened separate trading accounts with a registered stockbroker in 1999. The stockbroker claimed that the husband and wife had agreed to operate the accounts jointly and share any liabilities arising from stock market transactions. By early 2001, the wife’s account had accumulated a substantial debit balance, while the husband’s account had a credit balance. On the husband’s oral instructions, the broker transferred funds from his account to the wife to offset the losses. However, following a stock market crash, the debit balance increased significantly, leading the broker to initiate arbitration proceedings against both spouses.

The arbitral tribunal ruled in favor of the stockbroker, holding both husband and wife jointly and severally liable for the losses. It found that the husband was actively involved in managing both accounts and had orally agreed to cover any shortfalls. The tribunal dismissed the husband's counterclaim, reasoning that the financial dealings between the parties demonstrated shared liability. While acknowledging SEBI guidelines requiring written authorization for fund transfers, the tribunal justified its decision based on the nature of their financial relationship.

When the husband challenged the award under Section 34 of the Arbitration and Conciliation Act, a single-judge bench of the Bombay High Court dismissed his plea. However, a Division Bench, on appeal under Section 37, overturned the tribunal’s ruling, holding that the husband’s liability was based on a private understanding, separate from stock exchange transactions. The High Court concluded that oral agreements could not override official trading records and SEBI regulations and ruled that the tribunal had no jurisdiction over the husband.

The stockbroker then approached the Supreme Court, which ruled in favor of the broker and reinstated the arbitral award. The Court held that the tribunal had jurisdiction under BSE Bye-law 248(a), as the oral agreement establishing joint and several liability was incidental to stock market transactions. It found that the husband's involvement in managing the accounts, along with his past conduct, supported the tribunal’s jurisdiction. The Court criticized the High Court for re-examining evidence, stating that it had overstepped its authority under a Section 37 appeal.

The Supreme Court ultimately upheld the arbitral tribunal’s decision, holding the husband jointly and severally liable with his wife for the debit balance. It directed them to pay Rs. 1,18,48,069/- along with 9% interest per annum from May 1, 2001, until full repayment. The ruling reinforces the validity of oral contracts in financial transactions and affirms that arbitral tribunals have jurisdiction over such disputes when they arise within the framework of stock exchange regulations.

- #Supreme Court

- #Arbitration

- #Joint Liability

- #Oral Contract

- #Stock Market

- #BSE Bye Laws

- #Arbitral Award

- #Legal Ruling

- #Financial Liability

- #Legal Jurisdiction

- #SEBI Guidelines

- #Legal News

- #Stock Broker

- #Legal Precedent

- #Arbitration Law

- #Supreme Court Ruling

- #Debt Balance

- #Legal Developments

- #India Law

- #Stock Trading

- #Court Decision

- #Justice PS Narasimha

- #Justice Sandeep Mehta