- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

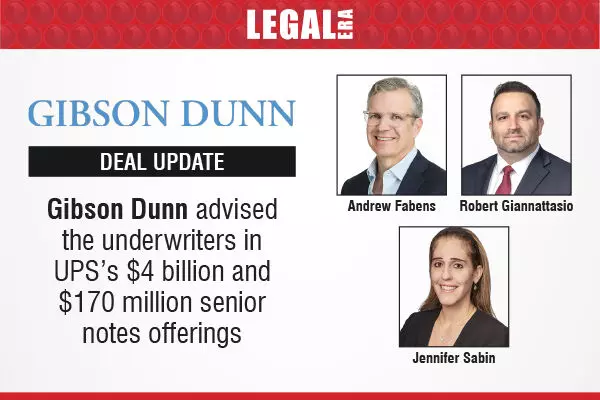

Gibson Dunn Advised The Underwriters In UPS’s $4 billion And $170 Million Senior Notes Offerings

Gibson Dunn advised the underwriters in UPS’s $4 billion and $170 million senior notes offerings

Gibson Dunn advised the underwriters in United Parcel Service’s (UPS) $4 billion offering of senior notes, comprising:

- $500 million 4.650% senior notes due 2030

- $1.25 billion 5.250% senior notes due 2035

- $1.25 billion 5.950% senior notes due 2055

- $1 billion 6.050% senior notes due 2065

Barclays Capital, Citigroup Global Markets, Goldman Sachs, SG Americas Securities, and Wells Fargo Securities acted as joint book-running managers for the offering.

Gibson Dunn also advised the underwriters in UPS’s $170,673,000 offering of floating rate senior notes due 2075. Goldman Sachs, J.P. Morgan Securities, Morgan Stanley, RBC Capital Markets, and UBS Securities acted as joint book-running managers for this offering.

The Gibson Dunn team was led by Andrew Fabens (Partner, New York) and Robert Giannattasio (Partner, New York), with support from Nneka Chukwumah (Associate), Kevin Mills (Associate), and Mackenzie Alpert (Associate). Jennifer Sabin (Partner, New York) advised on tax matters.

Click to know more about Gibson Dunn

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.