- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

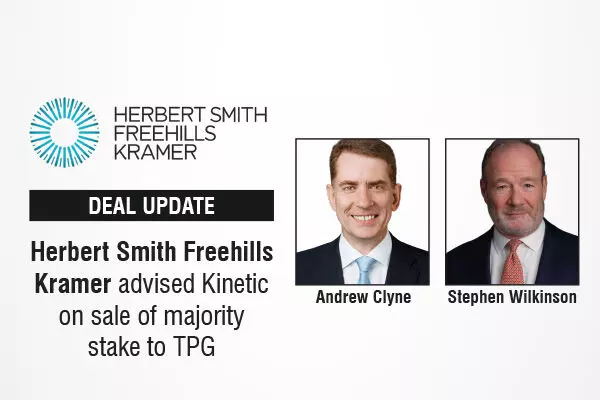

Herbert Smith Freehills Kramer Advised Kinetic On Sale Of Majority Stake To TPG

Herbert Smith Freehills Kramer advised Kinetic on sale of majority stake to TPG

The leading global law firm Herbert Smith Freehills Kramer (HSF Kramer) advised Australian bus operator Kinetic and its management team on the sale of a 70% stake in the business to US alternative asset management firm TPG.

Kinetic has grown to become the largest bus operator in Australia and New Zealand, with operations across the UK, Europe, and Singapore. The company is a leading operator of zero-emission transport and infrastructure, running over 300 electric buses and 11 electric depots across Australasia, and 1,500 electric buses in the UK through its majority-owned subsidiary, Go Ahead Group.

TPG acquired the stake via its TPG Rise Climate platform, led by the TPG Rise Climate Transition Infrastructure strategy. The investment brings TPG’s expertise in electrification and green mobility to Kinetic, marking a significant step in the company’s leadership in decarbonised transportation across Australia, New Zealand, and internationally.

“We are proud to have advised Kinetic on this important investment, which will help the company strengthen its commitment to building a net zero transport platform globally.”

– Andrew Clyne, Partner, Private Equity, Herbert Smith Freehills Kramer

The HSF Kramer transaction team was led by Andrew Clyne (Partner, Private Equity), with support from Marijana Banovac (Senior Associate), and solicitors Tess Meaden, Finn Edwards, and Mudit Dhami. The London team was led by Stephen Wilkinson (Partner), with support from Lucinda Grant (Senior Associate) and Rikesh Murva (Associate).

As part of the transaction, existing investor OPTrust exited its shareholding, while Foresight Group retained a 30% stake. The investment is subject to regulatory approvals and is expected to complete in the coming months.

Click to know more about Herbert Smith Freehills Kramer

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.