- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

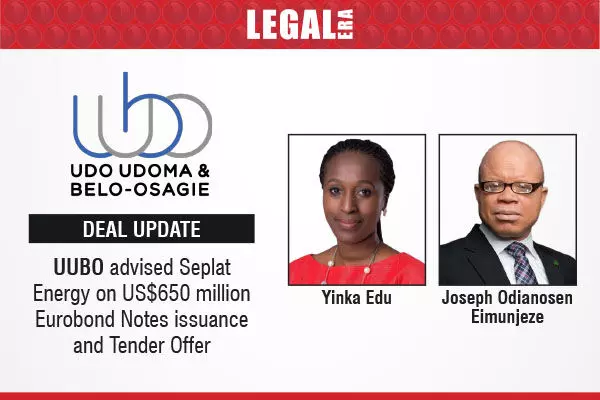

UUBO Advised Seplat Energy On US$650 Million Eurobond Notes Issuance And Tender Offer

UUBO advised Seplat Energy on US$650 million Eurobond Notes issuance and Tender Offer

Udo Udoma & Belo-Osagie (UUBO) advised Seplat Energy Plc as Nigerian counsel, with Latham & Watkins acting as English counsel, in connection with its US$650 million Eurobond Notes issuance (the “2030 Notes”) and its Tender Offer to purchase for cash all of its outstanding US$650 million 7.750% Senior Notes due 2026 (the “2026 Notes”).

The 2030 Notes were priced at 9.125% and are registered as Regulation S Global Notes and Rule 144A Global Notes, with a maturity in 2030. The proceeds from the 2030 Notes are being used to redeem the 2026 Notes pursuant to the Tender Offer and to finance general corporate purposes.

Following the closure of the Tender Offer, Seplat accepted US$567.46 million in aggregate principal amount of the 2026 Notes, representing approximately 87.3% of the principal amount outstanding.

The UUBO Capital Markets team was led by Yinka Edu (Partner) and Joseph Odianosen Eimunjeze (Partner), with support from Lisa Esamah (Senior Associate), and Damilola Opayinka, Omeiza Alao, Adaobi Omosefe Uzo, and Joel Adeyemi Adefidipe (Associates).

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.