- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

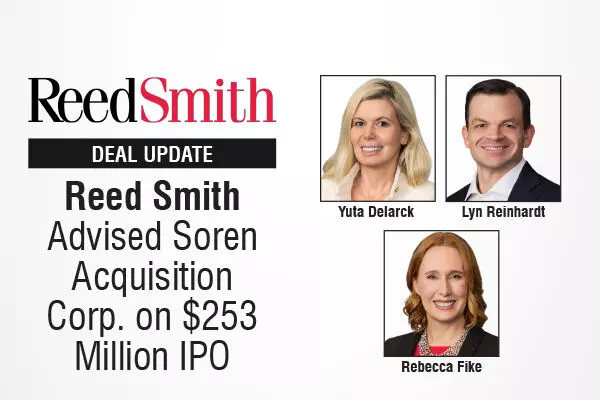

Reed Smith Advised Soren Acquisition Corp. On $253 Million IPO

Reed Smith Advised Soren Acquisition Corp. On $253 Million IPO

Global law firm Reed Smith advised Soren Acquisition Corp. (the “Company”), a special purpose acquisition company led by CEO Arghavan Di Rezze, J.D., on its $253 million initial public offering of 25,300,000 units at a price of $10.00 per unit, including 3,300,000 units issued pursuant to the full exercise of the underwriters’ overallotment option.

The Company’s units began trading on January 7, 2026, on Nasdaq under the ticker symbol “SORNU.”

Each unit consists of one Class A ordinary share and one-third of one redeemable warrant, with each whole warrant entitling the holder to purchase one Class A ordinary share at an exercise price of $11.50 per share.

Once the securities constituting the units begin separate trading, the Class A ordinary shares and warrants are expected to trade under the symbols “SORN” and “SORNW,” respectively.

The Reed Smith team was led by Yuta Delarck (Partner), Lyn Reinhardt (Partner), and Alaina Billingham (Associate). It also included Rebecca Fike (Partner), and Meredith Anderson (Associate), Ana Matovic (Associate), and Carolyn Rietig (Associate).

Click to know more about Reed smith

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.