- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

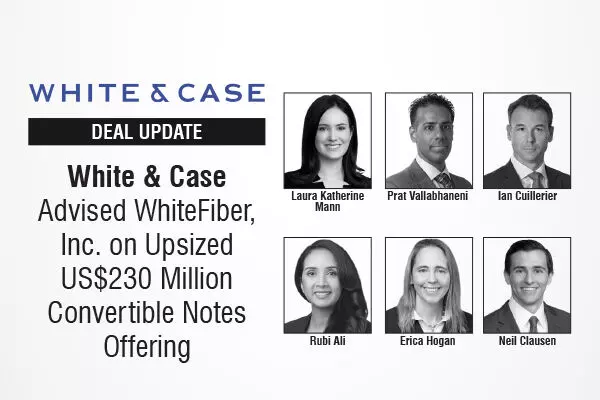

White & Case Advised WhiteFiber, Inc. on Upsized US$230 Million Convertible Notes Offering

White & Case Advised WhiteFiber, Inc. on Upsized US$230 Million Convertible Notes Offering

Global law firm White & Case LLP has advised WhiteFiber, Inc., a provider of artificial intelligence infrastructure and high-performance computing solutions, on its upsized private offering of US$230 million aggregate principal amount of 4.500% convertible senior notes due 2031.

The net proceeds to WhiteFiber from the offering, including the full exercise of the initial purchasers' option to purchase additional ordinary shares, were approximately US$221.5 million, after deducting the initial purchasers' discount and estimated offering expenses.

WhiteFiber used a portion of the net proceeds from the offering to pay the cost of the zero-strike call option transaction, as described below, and intends to use the remaining net proceeds from the offering primarily for data center expansion, including to partially fund the lease or purchase of additional property or properties on which to build additional WhiteFiber data centers; to construct those facilities; to enter into additional energy service agreements for each additional site and to purchase-related equipment, as well as for potential acquisitions, partnerships and joint ventures related thereto; and for working capital and general corporate purposes.

In connection with the pricing of the notes, WhiteFiber entered into a privately negotiated zero-strike call option transaction with an affiliate of one of the initial purchasers, with an expiration date that is scheduled to occur shortly after the maturity date of the notes.

The White & Case team was led by Laura Katherine Mann (Partner/ Capital Markets/ Houston) and Prat Vallabhaneni (M&A Partner/ New York), and included Ian Cuillerier (Partner/ Capital Markets/ New York) and Rubi Ali (Partner/ Capital Markets/ New York); Erica Hogan (M&A Partner/ New York); Neil Clausen (Partner/ Tax/ Houston); and Bryson Manning (Associate/ Capital Markets/ Houston) and Daniel Quesenberry (Associate/ Capital Markets/ Houston). Salma Abouhashish (Law clerk/ New York) also assisted on the matter.

Click to know more about White & Case

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.