- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

"It is imperative for businesses to board the ESG train now. ESG is about sustainability and investing in our collective future."

"It is imperative for businesses to board the ESG train now. ESG is about sustainability and investing in our collective future."

"It is imperative for businesses to board the ESG train now. ESG is about sustainability and investing in our collective future." LE: Let's start at the beginning. What are the fundamentals of ESG, and how does one relate to it? ESG or Environmental, Societal, and Governance can be traced back to the early days of socially responsible investing. In the 70s and 80s, if you picked up...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

"It is imperative for businesses to board the ESG train now. ESG is about sustainability and investing in our collective future."

LE: Let's start at the beginning. What are the fundamentals of ESG, and how does one relate to it?

ESG or Environmental, Societal, and Governance can be traced back to the early days of socially responsible investing. In the 70s and 80s, if you picked up the financial statements of Indian public-sector companies, you'd find an extensive section on resources deployed on sustainability, societal intervention, local community development and corporate responsibility. So, in its most basic context, ESG awareness and corporate fiduciary has always existed – it is only now taking centerstage and becoming an imperative with clearly defined goals.

As a young trainee article clerk during my chartered accountancy training, I was fascinated to peruse the balance sheets of these PSUs which undertook their societal responsibilities with the seriousness that it truly deserved. They were the hallmarks of corporate social responsibility. They built their factories and hubs in remote areas and contributed to improvement in the lives of communities around these rural setups.

While ESG is now evolving towards a mandated obligation by all stakeholders, we've always had an inherent value system – an ethos of giving back to communities, perhaps without appropriate metrics and reporting. It is clear that corporates that built strong foundations of trust through transparency, good governance, preservation of environment and societal consciousness benefited from consistent higher market cap multiples than industry peers who lagged in these metrics. They benefited from implicit trust from its stakeholders.

With higher sensitization on ESG given our current ecosystem, investors are also discerning and demanding clear evidence of higher levels of ESG and developing sophisticated models to measure impact. Large global and domestic lenders are moving fast in the same direction. Green financing and ethical lending are fast gaining momentum and entities displaying traits of institutionalizing ESG will attract more quality capital. Investors and lenders performance will also be measured on the same basis.

In essence, ESG is the culmination of these varying but related intersections around climate change, environmental sustainability, social responsibility, and human rights, together with a shared ethos for strong sustainable growth.

LE: Those are some excellent points. When you talk about sustainable investors, could you expand on what's in it for them? Is it just about choosing organizations that are already ESG centric?

Most fund managers are on the lookout for long-term interest for their investors and what they've realized is that companies who have focused on ESG or at least navigated within the vicinity of it have done significantly better. From a purely financial point of view, it makes a lot of sense to invest in these companies.

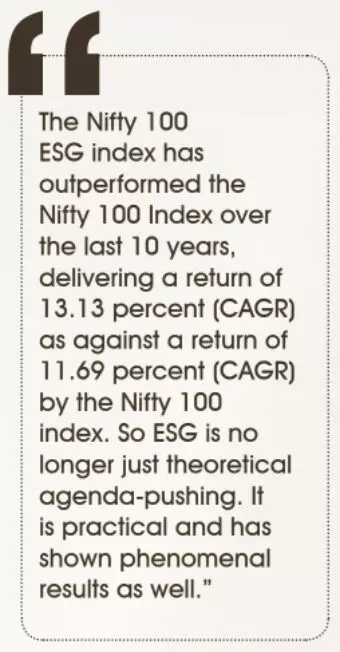

Investors have recognized that companies who are aware of these necessities of protecting environment and believe in sustainable development are far more resilient to market calamities. Consider the 2008 market crash; companies with brittle governance policies were far more vulnerable. Let's drill down even further; take a look at the global stock market, and you'll notice that the S&P-500 ESG Index – which is designed to measure the performance of securities against a sustainability criterion – has outperformed the S&P-500 index by 459 points from 2011 to 2021.

Now let's bring it closer to home. Data confirms that The Nifty 100 ESG index has outperformed the Nifty 100 Index over the last 10 years, delivering a return of 13.13 percent (CAGR) as against a return of 11.69 percent (CAGR) by the Nifty 100 index. So, this is no longer just theoretical agenda-pushing. It is practical and has shown phenomenal results.

LE: Even with all these metrics, there's always some confusion. When CSR was first enforced, there was a lot of resistance to it, correct? Will it be the same with ESG?

There is always some opposition to rules and regulations. The 2014 Company's Act was a precursor to CSR and required companies of a specific size to invest in CSR activities. Initially there was skepticism about the new CSR regulations. Over time the corporate sector realized the need and rationale to institutionalize the financial commitment and employee engagement in effective CSR.

Board CSR committees were formed to formulate and extend support to specific causes. The CSR Board committees are playing far more active role towards financially supporting and more encouraging employee engagement towards building sustainable communities. Employee participation becomes critical towards sustained community impact. Eventually, these community initiatives have to be ingrained in the DNA of the organizations as they build a culture of giving and sharing. Measuring outcomes facilitates more meaningful use of corporate resources.

LE: CSR and ESG could almost be the same thing. Are there any distinguishing factors between the two?

ESG is a much broader umbrella under which CSR sits and is much more of a value system. By building a value system within your organization or creating awareness, you are leaving behind an embedded legacy. This legacy is your current responsibility and comes from an innate need to create a more conducive ecosystem for future generations. Will we provide them with a world that is thriving or one that is dying? None of this can even be considered without a set of strong and contemporary governance standards.

Let's consider moral science classes in school. It was about imbibing a certain standard of morals and ethics that are meant to guide you through your life journey. Corporate Boards are responsible for long-term strategic and sustainable organizational growth. By that virtue, they are also the guardians of ESG framework and have a fiduciary responsibility towards this important building block for any organizations.

ESG is more of a sustainable ecosystem that requires institutionalization in order to truly make a difference. It is regulated philanthropy. Philanthropy is about 3 T's - Time, Talent, and Treasure. When you are young, you have time to give back; as you develop, you also have the talent to lead and inspire. Finally, when you've laid the foundational layers, you have the ability to fund your philanthropic goals. This is how I believe ESG will evolve and progress within our entire corporate ecology.

LE: In this regard, how does a company become ESG driven?

Becoming ESG driven or focusing your efforts on ESG is about the mindset. People talk about India becoming a 5 trillion or 6 trillion-dollar economy. In my view, the most important metrics of having arrived at or crossing the $5 Trillion milestone, is dependent on the kind of ecosystem that we envisage building for the future generations. After, over 7 decades of country's independence, we are still grappling with fundamental issues relating to basic hygiene, sanitation, health, water, air and quality education infrastructure amongst other imperatives for life of dignity for all. If we do not heed the clarion call of ESG and Sustainable Development NOW – it will be just too late. It's vital to build commensurate institutional and contemporary regulatory architecture that will support the ESG initiatives.

In this context, given the significance of sustainable development, I believe that the legal fraternity can play a key role in the furtherance of the ESG agenda and help build an ethical edifice of a new India.

Like I mentioned earlier, the world is veering towards becoming investors in sustainable development. You want to back someone whose ethics you relate to and who also happens to do business well. It is imperative for businesses to board the ESG train now! ESG is about sustainably and investing in our collective future.

The newer generations are far more conscious of where they invest their time and resources. No one is carried away by brands or logos. They are reversing the pressure and checking the sustainable initiatives led by brands, what type of products they're manufacturing, or causes they're supporting. Everything from the packaging to the product is required to be eco-friendly. Consumer behavior is changing fast and with it, companies will have to adapt accordingly. This pressure will eventually trickle down to other sectors like legal, consulting, or servicing. Their clients will associate only with other ESG compliant firms and companies.

LE: That's an incredibly thought-out analysis of the shift towards ESG. Are there any other thoughts you'd like to leave with our readers?

Yes, I believe India is making giant strides towards adopting ESG or changing the mindset of the country. Think of the Paris Accord on climate change – India dug its' heels in even though the US, under the Trump administration – decided to exit.

It's imperative now that we have the regulations in place to make ESG genuinely successful.

Technology and data will play a critical role in how this framework develops, what we focus on, and how we drive various initiatives forward. It all needs to be carefully planned and balanced to build a better future.