- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Valuation Of Biological Resources In India For Research And Patenting For Commercial and research use

Valuation Of Biological Resources In India For Research And Patenting For Commercial and research use

Valuation Of Biological Resources In India For Research And Patenting For Commercial and research use The BDA has been proposed to be amended by way the BDA Bill of 2021 (Bill) which is currently before the Parliament India is a mega biodiversity nation with only 2.4% of the land area of the world, but accounting for 7.8% of the recorded species of the world. The rapid economic growth...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

Valuation Of Biological Resources In India For Research And Patenting For Commercial and research use

The BDA has been proposed to be amended by way the BDA Bill of 2021 (Bill) which is currently before the Parliament

India is a mega biodiversity nation with only 2.4% of the land area of the world, but accounting for 7.8% of the recorded species of the world. The rapid economic growth in India since its Independence and post economic liberalization has brought her within the ambit of leading world trade regulations' framework related to biological resources as well as IPRs. In the early 1990s, the WTO and the CBD were negotiated almost simultaneously with trade experts and economists in the forefront in the former and environmentalists and conservators of traditional knowledge in the latter convention to arrive at the international treaties aimed at uniform procedures among the members. The TRIPS requirements of the WTO along with the CBD regime establishes specific requirements related to the use of biological resources to create innovations.

The objectives of the TRIPS Agreement are promotion of technological innovation and transfer and dissemination of technology, to the mutual advantage of producers and users of technological knowledge and in a manner conducive to social and economic welfare, and to a balance of rights and obligations. The CBD is based on national sovereignty over indigenous bioresources, and national governments are to regulate access to genetic resources and ensure fair and equitable sharing of the benefits derived from biodiversity besides conservation and sustainable use of biodiversity. The mandate of CBD is threefold: (a) conservation of biodiversity, (b) sustainable use of its components, and (c) fair and equitable sharing of benefits arising from the use of genetic resources. 193 countries, including India, are signatories of CBD. The TRIPS Agreement, the CBD, and WIPO all have about 150 plus members emphasize the need of the countries to make the IPR and biodiversity regimes work together, while making the necessary adjustments or amendments to achieve their objectives.

The Indian Biological Act 2002 (BDA) accordingly regulates through the National Biodiversity Authority and its State Boards the Access and Benefit Sharing (ABS) of the bioresources thus requiring the users to obtain the prior permissions before using any bioresource. The Section 2(c) of BDA defines "biological resources" as plants, animals and micro-organisms or parts thereof, their genetic material and by-products (excluding value-added products) with actual or potential use or value but does not include human genetic material.

There are exemptions provided within the BDA to promote sustainable use of biological resources by way of notifying normally traded commodities and excluding value-added products and conventional agriculture, though they do not seem to be sufficient in view of their limited scope interpretation. Also, the specific exemptions to vaids and hakims require broadening to manufacturers of traditional products such as ayurvedic preparations, to encourage traditional industries. It may be noted that the prior permission requirement is not only for trading and transfer of bioresources but also for using bioresources for research and obtaining IPR on innovations related to them.

The prior permissions are granted under the BDA subject to the user signing an ABS agreement with the NBA or SBB agreeing to regularly update on the use of the bioresource and pay an amount as agreed upon in the said ABS agreement. The prior informed consent (PIC) and permission based on mutually agreed terms (MAT) are to form the pillars of ABS agreement. The amount payable for research permissions is currently fixed by the NBA and that for IPR and commercial use is based on the final product being sold by the user. The economic value of the bioresource in question is therefore critical to arrive at MAT to allow sustainable use. Thus, valuation of bio-resources is an integral part in the operationalization of the CBD mandate.

As each bioresource and its utility is unique, development of standard yet flexible valuation methods for valuation of bio-resources is critical. Most of the environmental economics literatures emphasize on the valuation of biodiversity in view of the ecosystem at large. However, there is a requirement of developing the valuation methods for identifying the true value of bio-resources or their use and products from an innovation perspective. Current models of benefit sharing are generally based on fixation of a percentage of gross sale of products. However, the real economic value of biological resources is hardly understood by the providers as well as users, primarily due to the complexity in valuation and methodology deficiencies which is a fundamental problem in arriving at meaningful and suitable ABS agreements.

The negotiation between a provider and a user of resources should be based on the true/actual value of the resources and at the same time, provide incentive to the user to use the biological resource instead of looking for alternatives. Hence, understanding the real value of bio-resources is a pre-requisite for equitable benefit sharing and signing of ABS agreements.

There is no valuation mechanism for access of biological resource for research purposes currently. Research access permission is not required for Indians but if an Indian company has an NRI director/stakeholder, the permission is mandatory similar to non-Indians. A fixed fee is imposed for the prior permission for research using Indian Biological resource, irrespective of the same commonly being sold in the market. For example, permission for using coffee purchased from market for ₹ 1000 for research would require a fixed fee payment of ₹ 10000 at the time of signing the ABS agreement, which is a prerequisite even for Research permissions and not just at the time of commercialization of research results or transfer. This acts as hindrance to research using Indian bioresources and valuation for the fee to be imposed or not needs to be done. A simple intimation for research using common bioresources would be more logical and fairer.

The permission for IPR-related commercial use also lacks a proper valuation mechanism. The standard ABS agreement does not take into consideration the difference in bioresources or the difference in its use or products, leave aside the different industry sectors.

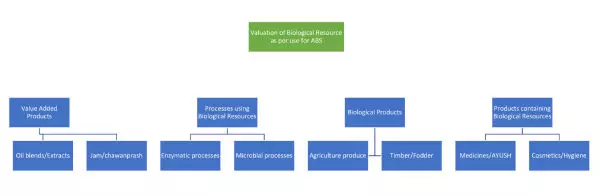

Valuation of Biological Resource for its various uses in the innovative products for which the commercial working statement is made by the patentee cannot be same for all inventions. The use of the bioresources in the final product may be very different (see Figure 1) including a value-added product to be the final commercial product (e.g. Jam). The contribution of a Biological Resource in a biotechnological process is completely different than that used in direct use products such as timber (e.g. Red sandalwood). The value chain analysis is essential for the herbal medicine industry, and the use of minor amounts of bioresources in otherwise chemical products (e.g. shampoo with natural fragrance). The process of chromatography of a bioresource to evaluate the chemical profile or the use of pests for testing of chemical pesticides are completely different uses of bioresources and imposition of any ABS for such use would need to be evaluated using an entirely distinct approach.

Figure 1

The various valuations methodologies for bioresource valuation as being considered by NBA for ABS amount calculations include: (1) Maximum Willingness to Pay Approach: This method is for bio-resources that may be an unavoidable input factor in the final product. The industry negotiates the amount set by provider and the negotiated value can act as the "real value" for the resources. The current ABS agreements as provided as standard by the NBA are based on this method. However, this method does not take into consideration the contribution of the bioresource in the final product. (2) Value Chain Analysis: This method is suggested for bio-resources which are basic raw-materials for manufacturing final consumer products. It is important to realize that many other products (inputs) and knowledge/skill (research and development) also contribute to the final product. Hence, the raw material costs and processing or manufacturing costs at different stages are significant factors and for valuation requiring use of an amortized pricing technique to estimate the real price of the bio-resources. (3) Minimum Support Price for Bio-resources: The authority should know the price of such goods / commodities to follow this method. The collector communities' willingness to accept is also to be considered. The expert committee on the "Development of Methodology for Economic Valuation of Bio-resources" established at NBA, proposed the concept of rent and its recovery for benefit sharing.

The standard ABS agreement does not take into consideration the difference in bioresources or the difference in its use or products, leave aside the different industry sectors

Concluding Remarks

The BDA has been proposed to be amended by way the BDA Bill of 2021 (Bill) which is currently before the Parliament. The Bill on one hand clarifies what the term "access" means by defining it to "collecting, procuring or possessing any biological resource occurring in or obtained from India or associated traditional knowledge thereto, for the purposes of research or bio-survey or commercial utilization". On the other hand, the Bill further covers within the definition the bioresource derivatives to mean 'a naturally occurring biochemical compound or metabolism of biological resources, even if it does not contain functional units of heredity', thereby creating another point of interpretation. There are several other concerns of various industries that remain unanswered in the proposed bill and hence a standing committee is deliberating on the same taking stakeholder comments. The amended BDA would hopefully have provisions for MAT and valuations method based on case-specific formulae which assess the true value of biodiversity and its products rather than imposing pre-set figures which do not take into consideration the real value of the bioresource.

Disclaimer – The views expressed in this article are the personal views of the author and are purely informative in nature.