- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

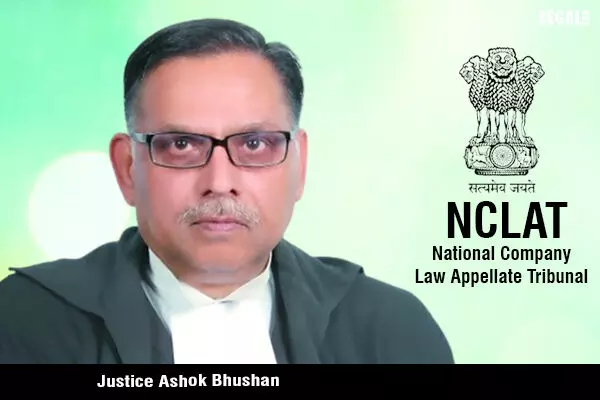

NCLAT Chairperson- Justice Ashok Bhushan highlights need for an IBC Amendment to Ensure Due Share for Operational Creditors, emphasizes on the Need to train IRPs

NCLAT Chairperson- Justice Ashok Bhushan highlights need for an IBC Amendment to Ensure Due Share for Operational Creditors, emphasizes on the Need to train IRPs

The former judge of Supreme Court and the current judge of the National Company Law Appellate Tribunal (in short NCLAT) was invited as the chief guest at the book launch of the second edition of Eastern Book Company's 'Insolvency and Bankruptcy Code' by A.K. Mittal.

During the virtual book launch, the Chairperson stated that the act of enacting insolvency laws in India was one of the two most important movement dome in the Indian legislative policy and the second was introduction of goods and service tax which successfully replaced multiple indirect taxes levied by both the central government and the state governments.

The guest of honor at the virtual book launch was Justice Rajiv Shakdher of the Delhi High Court. Also in attendance were other eminent personalities in the legal fraternity.

Recently, the Insolvency and Bankruptcy Board of India had conducted a two-day colloquium with the Finance Minister in attendance. The Chairperson stated, "All shortcomings in the legislation were discussed and recommendations have been some submitted to the government to bring the necessary changes." One of the most significant topics at the event was the dues of operational creditors.

As per the Insolvency and Bankruptcy Code, 2016 (in short IBC) there are different kinds of creditors classified based on their roles while a company is still solvent including financial and operational creditors as key entities. Presently in the scheme, financial creditors are given more priority and carry voting rights in the Committee of creditors contrary to operational creditors who are not the members of the committee.

Justice Bhushan while highlighting the need for an amendment to Section 53 of the IBC expressed his view and stated, "the maximum casualty is of the operational creditor who are at the very bottom of the distribution chain. The financial creditors take the major share, while the operational creditors get nothing."

"The legislature may take a call on this. We hope that this year, we will have some more amendments in the code addressing the pertinent issues." He further added.

One of the inadequacies practices in the insolvency architecture is that the professionals are often caught up in small things, resulting them to focus less on the larger objective of the code, which is to provide succor to distressed companies and maximize the overall wealth and welfare of the economy opined the Chairperson.

"There should be a cadre of insolvency professionals so that they are accountable to a body. In fact, we have recommended that the government create a cadre and provide proper training and education. Competent professionals are likely to take insolvency resolution on the right track and prevent liquidation," the Chairperson asserted.