- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

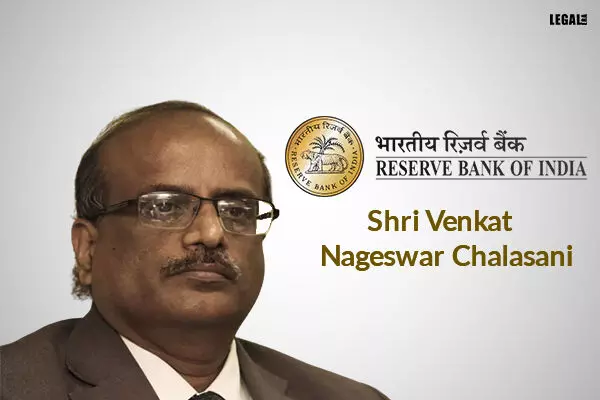

RBI appoints Shri V N Chalasani as a member in the Advisory Committee of SIFL and SEFL

RBI appoints Shri Venkat Nageswar Chalasani as a member in the Advisory Committee of Srei Infrastructure Finance Limited (SIFL) and Srei Equipment Finance Limited (SEFL)

The Reserve Bank of India (RBI), vide order dated 11 October 2021 had constituted an Advisory Committee under Rule 5(c) of the Insolvency and Bankruptcy (Insolvency and Liquidation Proceedings of Financial Service Providers and Application to Adjudicating Authority) Rules, 2019.

The Advisory Committee was constituted to advise Administrators in the operation of financial services provided during the Corporate Insolvency Process.

Upon the resignation of Shri R. Subramaniakumar from the Advisory Committee with effect from June 22, 2022, the RBI has appointed Shri Venkat Nageswar Chalasani as a member of the Advisory Committee with immediate effect.

Currently, the Advisory Committee consists of the following members:

1. Shri Venkat Nageswar Chalasani, Former Deputy Managing Director, State Bank of India.

2. Shri T.T. Srinivasaraghavan former Managing Director, Sundaram Finance Limited.

3. Shri Farokh N Subedar former Chief Operating Officer and Company Secretary, Tata Sons Limited.

In October 2021, the RBI had filed applications before the NCLT Kolkata bench for initiating corporate insolvency resolution process (CIRP) against Srei Infrastructure Finance Limited (SIFL) and Srei Equipment Finance Limited (SEFL).

It is to be noted that Sre Group has a huge debt of around ₹18,000 crore owing to about 15 lenders including Axis Bank, UCO Bank, and SBI.

The Group has also other debts by way of external commercial borrowings and bonds to the tune of about ₹10,000 crore.