- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

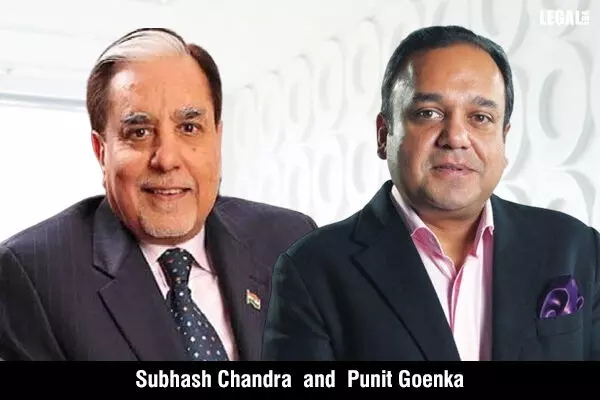

SAT directs SEBI to file response to Subhash Chandra and Punit Goenka’s appeal within 48 hours

SAT directs SEBI to file response to Subhash Chandra and Punit Goenka’s appeal within 48 hours

The next hearing has been scheduled for 19 June

The Securities Appellate Tribunal (SAT) has directed the Securities and Exchange Board of India (SEBI) to respond to the appeal filed by the Essel Group chairman, Subhash Chandra and CEO of Zee Entertainment Enterprises Limited (ZEEL), Punit Goenka. This was against an order barring the two from holding directorial or key managerial posts in listed companies.

A bench comprising Justice Tarun Agarwala and presiding officer Meera Swarup asked SEBI to file its response within 48 hours and posted the case for a final hearing on 19 June.

The tribunal in its order stated, "Passing an order at this stage will be virtually allowing the appeal. We are of the opinion that the appeal should be heard finally and SEBI must file the reply within 48 hours."

Chandra and Goenka had challenged an interim order passed by SEBI that barred them from holding directorial or key managerial positions in any listed company or its subsidiaries.

Filed through Economic Law Practice, the appeal claimed that the SEBI order involved a violation of the principles of natural justice. The appellants highlighted that no show-cause notice was issued to them before the SEBI order.

Appearing for the appellants, Senior Advocate Janak Dwarkadas said it was a clear case of a "post-decisional hearing situation." He clarified that he was not challenging the competency of the regulatory authority to exercise power in exceptional cases.

Dwarkadas emphasized, "A post-decisional hearing can be afforded, but in situations which cannot wait to preserve the status quo. This case does not fit into the exceptional cases carved out by this court."

The tribunal noted that the appellants were granted 21 days’ time to respond to the order. It asked the advocate to explain why intervention was required now.

The counsel invoked Articles 19(1)(g) (Freedom to Trade) and 21 (Right to Live with Dignity) of the Indian Constitution.

He argued that even a minute’s interference with a person’s fundamental right to carry on business or (as in the present case), to hold a post, would be destructive for the individual. He alleged, "There has been no investigation. They have merely jumped to certain conclusions, which are unwarranted."

The advocate added that the order would have repercussions on a case pending before the National Company Law Tribunal (NCLT) concerning a merger between ZEE and Sony.

The tribunal asked Senior Advocate Darius Khambata, who appeared for the SEBI, how much time it would take to complete the investigation, which has been going on for the last four years.

Since Khambata sought time to take instructions from his client on this aspect, the tribunal adjourned the matter for a final hearing on 19 June.