- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

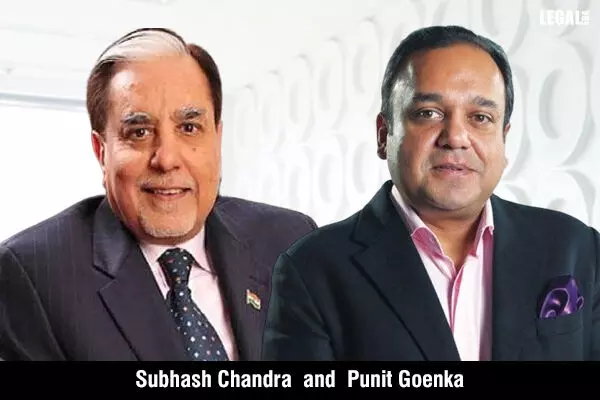

SEBI restrains Subhash Chandra and Punit Goenka from holding key posts in listed companies

SEBI restrains Subhash Chandra and Punit Goenka from holding key posts in listed companies

The market regulator said it was their well-planned scheme to siphon off the funds for their own benefit

The Securities and Exchange Board of India (SEBI) has passed an interim order barring Essel Group chairman, Subhash Chandra and Zee Entertainment Enterprises Limited (ZEEL) Chief Executive Officer, Punit Goenka from holding directorial or key managerial positions in any listed company or its subsidiaries.

Ashwani Bhatia, a whole-time member of SEBI, passed the order noting that Chandra and Goenka abused their position as directors/KMPs of a listed company by siphoning off funds for their own benefit. They alienated the assets of ZEEL and other listed companies of the Essel Group for the benefit of associate entities owned and controlled by them.

While stating that the siphoning off of funds appeared to be a well-planned scheme, SEBI directed, "The noticee’s shall cease to hold the position of a director or a key managerial personnel in any listed company or its subsidiaries until further orders."

In its order, SEBI added, "The siphoning off of funds appears to be a well-planned scheme since, in some instances, the layering of transactions involved using about 13 entities as pass-through entities within just two days. It is a fact that some of the entities used in these layers are common to the ones used for fund diversion in the Shirpur Gold Refinery Limited case. This strengthens the prima facie finding that funds have been diverted from ZEEL, which needs to be investigated thoroughly.”

It is to be noted that during the Financial Year 2018-19 to 2022-23, the share price of ZEEL came down from Rs. 600 per share to the current price of less than Rs. 200 per share.

The market regulator observed, "This erosion of wealth, despite the company being so profitable and generating profit after tax consistently, would lead to a conclusion that all was not well with the company. During this period, the promoter shareholding dropped from 41.62 percent to the current level of 3.99 percent.”

It was said that the noticee’s created a façade through sham entries to misrepresent to the investors as well as the market regulator that money had been returned by associate entities. However, the reality was that ZEEL’s own funds were rotated through multiple layers to finally end up in ZEEL’s account again.

Furthermore, the SEBI order said, "The noticee’s have attempted to ride piggyback on the success of ZEEL, the flagship company of Essel Group, to bankroll the associate entities, which are owned and controlled by them.”

SEBI's probe into the matter began after two independent directors of ZEEL, Sunil Kumar and Neharika Vohra resigned in November 2019. They had raised concerns over several issues, including the appropriation of certain fixed deposits of ZEEL by Yes Bank for squaring off loans of related entities of the Essel Group.

SEBI’s investigation into the matter revealed that Subhash Chandra, the then Chairman of ZEEL/Essel Group, had provided a Letter of Comfort (LoC) dated 4 September 2018 towards credit facilities availed by certain group companies from Yes Bank.

Neharika Vohra’s resignation of 22 November 2019, submitted to the chairman of the Board of Directors of ZEEL, had maintained that the LoC was known only to a few persons in the management. She added that even the Board of ZEEL was not aware of it.

SEBI observed that on the basis of that LOC, Yes Bank had adjusted a fixed deposit of Rs.200 crores of ZEEL for meeting the obligations of the seven associate entities towards Yes Bank. The seven entities were owned/controlled by the family members of Chandra and Goenka.

When SEBI probed the going-ons, ZEEL submitted that Rs.200 crores, equivalent to the value of the fixed deposit that was encashed by Yes Bank for the dues from associate entities owned by the promoter family, had subsequently been received back from those associate entities in September/October 2019.

The market regulator stated, "Though ZEEL had confirmed the receipt of Rs.200 crore from the associate entities, SEBI found inter alia that Subhash Chandra and Punit Goenka, by signing comfort letters on behalf of ZEEL without informing, consulting, and/or approval of ZEEL or its board, had violated Regulation 4(2)(f)(i)(1)&(2), 4(2)(f)(ii)(6) and 4(2)(f)(iii)(3)&(6) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.”

Thereafter, it probed the matter further and, in order to examine the claim of ZEEL regarding the receipt of funds, SEBI sought bank statements of ZEEL and other entities from various banks.

The order read that an analysis of the bank statements showed that although ZEEL had claimed to have received Rs.200 crores from the seven associate entities of the promoters, the major portion of the funds had originated from either ZEEL itself or the listed companies of the Essel Group. These, after passing through several layers, reached the accounts of the associate entities from where it ultimately landed in ZEEL’s account.

SEBI further stated, "The funds had originated from ZEEL/other listed companies of Essel Group, which moved through multiple layers of promoter family-owned or controlled entities and was ultimately transferred to ZEEL, in order to show the fulfillment of payment obligations of the associate entities towards ZEEL. The flow of funds clearly indicates that there was no actual net receipt of funds by ZEEL and these were merely book entries to show receipt of funds.”

It added, “Thus, it appears that ZEEL’s own funds/funds from other listed companies of Essel Group were used to give an impression that the associate entities had indeed returned the money they owed to ZEEL as a result of the invocation of LoC given by Subhash Chandra against ZEEL’s fixed deposit of Rs.200 crores.”

While passing the interim directions against Chandra and Goenka, SEBI said that the disclosure in the Annual Report regarding payments from associate entities also appears to be a misstatement or a misrepresentation.