- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

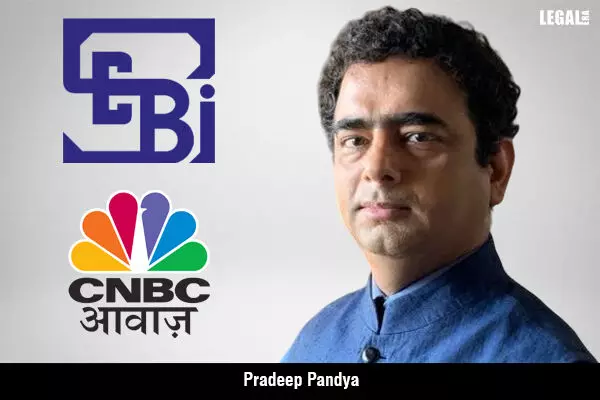

SEBI Slaps 5-Year Ban On Former CNBC Anchor Pradeep Pandya And Seven Others Over Fraudulent Trading Practices

SEBI Slaps 5-Year Ban On Former CNBC Anchor Pradeep Pandya And Seven Others Over Fraudulent Trading Practices

Refers to the judgment of the Supreme Court of India and the United States’ top court

The Securities and Exchange Board of India (SEBI) has banned Pradeep Pandya, a former news anchor, known for his stock market shows, along with seven other entities, for five years. The decision came in response to the findings of fraudulent trading practices and breaches of ethical standards within the industry.

The regulatory measures were prompted by an investigation into the trading activities of Pandya and his association with technical analyst Alpesh Furiya.

Pandya, previously a host on CNBC Awaaz, was found to have shared confidential information about upcoming stock recommendations with Furiya, who utilized the privileged information to execute trades through his accounts and related entities.

SEBI held that there was systematic exploitation of information asymmetry within the securities market. The investigation revealed a coordinated effort to profit from non-public information. The actions breached ethical standards and eroded investor confidence in the integrity of the market.

It held that Pandya violated the Prohibition of Fraudulent and Unfair Trade Practices (PFUTP) norms. And both Pandya and Furiya violated the SEBI (Prohibition of Insider Trading) Regulations, 2015, which aim to prevent trading based on non-public information that could affect the prices of securities.

The inquiry revealed a clear instance of insider trading, wherein Pandya shared advance information about stock recommendations with Furiya.

The regulatory body cited the decision of the Supreme Court in the SEBI vs Kanaiyalal Baldev Patel case, wherein the top court emphasized the significance of ‘equal access to information’ in the securities market. It highlighted the detrimental effects of unfair practices stemming from information irregularity.

SEBI also referred to the decision of the US Supreme Court in the David Carpenter vs United States. The matter pertained to David Carpenter, a trader who engaged in securities transactions using information obtained from a columnist for The Wall Street Journal. The decision reached through a split 4-4 ruling. It was, subsequently, clarified in the case of United States vs O'Hagan, establishing the misappropriation theory as a basis for determining fraudulent activities in securities trading.

Under the theory, individuals commit fraud in securities transactions when they misappropriate confidential information for trading purposes in breach of a duty owed to the source of the information.

Apart from barring Pandya, Furiya, and other entities from accessing the securities market, SEBI has levied a collective fine of Rs.2.6 crores on them.