- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

E-Bills of Lading the Smart Choice Going Forward?

E-Bills of Lading the Smart Choice Going Forward?

E-BILLS OF LADING THE SMART CHOICE GOING FORWARD? While usage of EBLs within closed systems has gained popularity in recent years, it is its usage in open systems which will truly herald the era of EBL A bill of lading is an indispensable transport document issued by a carrier to the shipper which serves primarily as a receipt for goods loaded onto the carrier's vessel. Apart from this,...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

E-BILLS OF LADING THE SMART CHOICE GOING FORWARD?

While usage of EBLs within closed systems has gained popularity in recent years, it is its usage in open systems which will truly herald the era of EBL

A bill of lading is an indispensable transport document issued by a carrier to the shipper which serves primarily as a receipt for goods loaded onto the carrier's vessel. Apart from this, the bill of lading frequently evidences the terms of the contract of carriage and, by its endorsement, can transfer not only possessory rights but also rights of ownership on the goods described therein.

Adoption of electronic bills of lading ("EBLs"), as a functional replacement for paper bills of lading, has been touted for a while now and considering the monetary, logistical, and environmental advantages of using EBLs, it is not difficult to see why. An oft cited 2014 study conducted by Maersk followed a refrigerated container from Kenya to the Netherlands and found that over 200 interactions were generated for that shipment alone with over 30 separate actors involved.

Recent strides in information technology have overcome obstacles which previously prevented EBLs from replicating the key functions of a traditional paper bill of lading and EBLs are steadily becoming a genuine alternative.

WHAT ARE EBLs AND HOW DO THEY WORK

Contrary to what many believe, EBLs are not a mere "soft-copy" or electronic version of traditional bills of lading but are, in fact, a series of computer-generated electronic messages which can only be transmitted and deciphered electronically.

While the receipt and contract functions of a bill of lading are relatively straightforward to replicate, the ability for an EBL to transfer contractual and possessory rights over the goods has been a challenge.

Until recently, EBLs could be used effectively only within closed, member-only systems based on a central registry such as Bolero, essDocs or E-Title. These private platforms create a legal ecosystem by requiring its members to sign a multiparty agreement wherein members agree to treat EBLs as a document of title thereby conferring upon the holder of an EBL the same rights and obligations as the lawful holder of a traditional bill of lading. The usage of EBLs in such a 'Registry Model' received a huge boost when the International Group of P&I Clubs approved certain EBL platforms wherein any liability arising under an EBL issued under an approved platform is treated for Club cover purposes in the same way as if it was a paper bill. This requirement of membership is a major obstacle to the 'Registry Model' and none of the existing platforms have succeeded in reaching a critical mass in their membership.

The advent of distributed ledger technology and blockchain has now brought with it the possibility of creating a transferable document with a 'guarantee of uniqueness' even in an open system. Unlike the Registry Model, transactions could take place peer-to-peer on an open platform without the need for prior subscription to any platform thus paving the way to more widespread usage. This 'Token Model' can ensure that there is only one 'holder' of an EBL at any given time and a blockchain based EBL can, in theory, be functionally equivalent to a paper bill of lading. Such a blockchain based EBL could potentially be considered a "Negotiable Electronic Transport Record" as envisaged by the Rotterdam Rules.

ADVANTAGE OF EBLs OVER TRADITIONAL BLS

a) Costs: Apart from savings associated with printing and moving the documents, operating costs including storage of cargo at discharge port of cargo will significantly reduce.

b) Speed: EBLs are stored in a digital format and can be seamlessly transferred in minutes rather than weeks, which a courier would take.

c) Security: Records of transactions are encrypted and stored in secure systems reducing the possibility of the document being forged, manipulated, or stolen. Possibility of human error is also greatly reduced.

d) Transparency: Since EBLs can be transferred almost instantaneously, timely delivery of the EBL is assured even for voyages of a shorter duration, eliminating the necessity for letters of indemnity.

e) Environmental Impact: Especially considering that bills of lading are usually issued in sets of three, a paperless process is manifestly better for the environment.

LEGAL CHALLENGES

For EBLs to work, either of the two things, namely, appropriate contractual provisions or statutory imposition, are necessary.

Parties to a sale agreement can contractually agree to use an EBL and this arrangement would work amongst the parties involved. If any party fails to honor its contractual agreements, remedies for breach of contract would be available. While this is fine for platforms which rely on contractual mechanisms for their validity, a third-party outside this contractual framework such as a buyer or an endorsee / holder of a blockchain-based EBL would not be able to assert his title over the goods in the absence of an empowering legislation giving him this right.

Under English Law, this empowering legislation which seeks to overcome this problem of privity of contract is the Carriage of Goods by Sea Act, 1992V ("COGSA") gives the 'lawful holder' of a bill of lading all rights of suit under the contract of carriage and allows the 'lawful holder' to sue the carrier directly under the contract of carriage. This legislation would not cover EBLs, since English Law, as it stands today, does not recognize the concept of "possession" of an electronic record and as a holder of an EBL would not be able to rely on the COGSA to give them rights to pursue claims against the carrier.

Section 1 of The Indian Bills of Lading Act, 1856 recognizes the right of a consignee of goods named on the bill of lading and every endorsee of a bill of lading to be vested with all rights of suit and be subject to the same liabilities in respect of such goods as if the contract contained in the bill of lading had been made with himself. While this position is yet to be tested, Indian Courts could differ with the English position as there is no equivalent of the English COGSA in Indian Legislation, with the only requirement to transfer contractual rights being the endorsement of the bill of lading and there is no question of possession of the document. This will of course be subject to the law recognizing the electronic endorsement of an EBL as being legally valid.

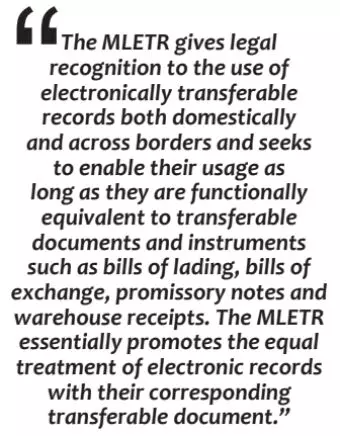

For an electronic bill of lading to be successful in an open system it needs to be supported by a robust legal infrastructure. In 2017, the United Nations Commission on International Trade Law ("UNCITRAL") formulated the UNCITRAL Model Law on Electronic Transferable Records ("MLETR"). The MLETR gives legal recognition to the use of electronically transferable records both domestically and across borders and seeks to enable their usage as long as they are functionally equivalent to transferable documents and instruments such as bills of lading, bills of exchange, promissory notes and warehouse receipts. The MLETR essentially promotes the equal treatment of electronic records with their corresponding transferable document. Only three countries (Singapore, Bahrain and Abu Dhabi Global Market) have adopted the MLETR and, given the cross-border nature of International Trade, widespread acceptance, and adoption of these rules amongst maritime nations will be necessary before EBLs can effectively be used in an open system.

CONCLUSION

While usage of EBLs within closed systems has gained popularity in recent years, it is its usage in open systems which will truly herald the era of EBL. The advent of blockchain which allows EBLs to be functionally equivalent to a paper bill of lading has paved the way for this and it now appears to be only a question of time before EBLs become the norm.

To leverage the numerous advantages that EBLs have to offer including speed, cost and transparency and facilitate its widespread usage within the shipping industry, it is necessary for jurisdictions to create a robust legal framework conducive to the usage of EBLs. The formulation of the MLETR is a huge development in this regard and whether it is swiftly adopted by jurisdictions across the globe is yet to be seen.

Disclaimer – The views expressed in this article are the personal views of the authors and are purely informative in nature.