- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Global Capability Centres, Startups & Corporate Social Responsibility: The Innovation Triangle India Needs

Global Capability Centres, Startups & Corporate Social Responsibility: The Innovation Triangle India Needs

Global Capability Centres, Startups & Corporate Social Responsibility: The Innovation Triangle India Needs This policy change (whereby private sector incubators associated with GCCs are also included within the ambit of mandated CSR spends) provides an opportunity for the CSR funds to be channelled into incubators and accelerators through which GCCs can support the startup eco-system...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

Global Capability Centres, Startups & Corporate Social Responsibility: The Innovation Triangle India Needs

This policy change (whereby private sector incubators associated with GCCs are also included within the ambit of mandated CSR spends) provides an opportunity for the CSR funds to be channelled into incubators and accelerators through which GCCs can support the startup eco-system while also simultaneously accelerating their own R&D mandates

India has been aiming to position itself globally as a thriving hub for startups, by spearheading robust government initiatives which are aimed at fostering innovation and entrepreneurship. Initiatives introduced by the government such as the Startup India Initiative, tax incentives, seed funding schemes, and regulatory relaxations are some of the ways through which the Indian government is trying to fuel its strategy of building a dynamic startup eco-system. Correspondingly, there has also been a surge in the presence of various multinational companies establishing Global Capability Centres (“GCCs”). GCCs are typically viewed as subsidiaries that handle the outsourcing functions and serve as the operations hub, providing services such as IT support, finance or performing analytics. Lately however, there has been a significant shift in this structure and a wide number of GCCs can now be seen to be actively conducting research and development (“R&D”) by leveraging the vast and relatively cost-effective science, technology, engineering, and mathematics (“STEM”) based talent pool that India has to offer. In the financial year of 2023-24 alone, 24 GCCs crossed the USD 1 billion export revenue milestone1. Several prominent global companies have established their GCCs in India, such as Microsoft, Amazon, JP Morgan and Bosch Global.

While various initiatives by the Indian government are aimed at ensuring greater corporate investment in startups, one can see the emergence of an opportunity at the intersection of GCC-driven R&D and Corporate Social Responsibility (“CSR”). The Companies Act 2013 specifies the requirement of CSR to be conducted by every company, upon the achievement of certain specified milestones and Schedule VII specifies the list of areas where such companies can invest to achieve their CSR targets. Section 135 of the Companies Act, 2013 and Schedule VII of the Companies Act, 2013 read with the Companies (Corporate Social Responsibility Policy) Rules, 2014 governs the CSR framework for all companies (including a foreign company having its branch office or project office in India). Any company with: (a) net-worth of INR 500 crores or more; or (b) turnover of INR 1000 crores or more; or (c) net-profit of INR 5 crore or more, in the immediately preceding financial year, will be required to contribute an amount equivalent to at least 2% of the average net profits during the immediately preceding three financial years, towards CSR. One of the areas, as laid down in Schedule VII, wherein companies can invest in order to achieve their CSR targets include “contribution to incubators or research and development projects in the field of science, technology, engineering and medicine, funded by the Central Government or State Government or Public Sector Undertaking or any agency of the Central Government or State Government”.

While Schedule VII allows for companies to channel funds earmarked for CSR activities towards supporting incubators/R&D projects, they can only do so for incubators and R&D projects funded by the government. This can pose a hurdle to the maximization of the private sector’s engagement.

While Schedule VII allows for companies to channel funds earmarked for CSR activities towards supporting incubators/R&D projects, they can only do so for incubators and R&D projects funded by the government

One may accordingly argue for a policy shift, wherein companies with GCCs in India may be allowed to invest their CSR funds into incubators/startups as well as R&D projects, which are associated with and/or cultivated by such GCCs on their own campus and in line with their specific R&D agenda (without the need for them being government-backed). This would enable startups incubated in such GCCs to gain access to field-specific mentorship, greater resources, and a bigger platform for networking while on the other hand providing GCCs an opportunity to tap into ideas that align with their R&D objectives, particularly in sectors such as clean energy, artificial intelligence, and fintech. Incubators being promoted by GCCs on their campus would also offer such GCCs access to a dynamic talent pool which would help such GCCs incorporate fresh perspectives and innovative ideas into their R&D strategies. This symbiotic relationship would ensure that both, the startups fostered at the GCC, as well as the GCCs themselves remain at the forefront of innovation and best practices.

This is already taking place in some measure, albeit at a very nascent stage. Until 2022, around 10% of the GCCs were actively engaged with startups, which had secured funding of approximately USD 8 million through the incubators placed within GCCs2. In a recent initiative, Jaguar Land Rover partnered with a global investor and corporate innovation platform, Plug and Play, to establish an innovation hub in Bangalore, aimed at connecting startups with its global engineering team to develop new technological, engineering, and sustainability solutions for the company3.

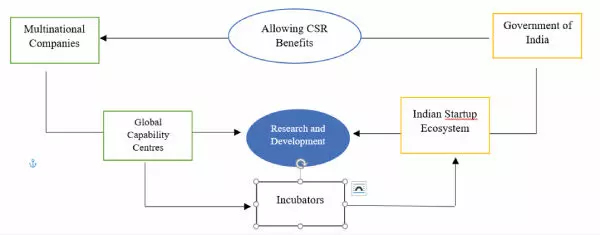

This policy change (whereby private sector incubators associated with GCCs are also included within the ambit of mandated CSR spends) provides an opportunity for the CSR funds to be channelled into incubators and accelerators through which GCCs can support the startup eco-system while also simultaneously accelerating their own R&D mandates.

A well-integrated model, in the way specified above, can help create a self-sustaining cycle:

- GCCs leverage their CSR funds to support incubators that nurture such startups which are aligned with their industry focus.

- Startups, in turn, gain critical, financial and mentorship support, which helps them scale and commercialize innovative solutions.

- Corporations benefit from access to cutting-edge technologies, potentially leading to strategic partnerships or acquisitions.

- India’s broader economy grows, in turn, generating employment, attracting investments, and cementing the country’s position as a global innovation hub.

Creating a Win-Win Model: Moving beyond compliance to strategic impact

Multinational corporations that operate and function in India have significant financial resources and their GCCs play a very important role in ensuring that their companies’ R&D mandates are fulfilled in line with the global growth agendas. By introducing changes and expanding these CSR provisions to include private incubators and by introducing structured collaboration programs such as the one discussed above, the government can foster an ecosystem wherein both GCCs as well as India’s startup ecosystems, stand to benefit.

For the GCCs in particular, aligning their CSR spending obligations with startup incubation offers dual perks. It helps them in meeting their regulatory requirements while furthering early access to disruptive technologies and innovative solutions. This alignment can help build deeper engagement with the country’s entrepreneurial ecosystem and also ensure a steady stream of innovations. Hence, it is important that CSR be viewed as a strategic tool (in the manner described above), rather than a mere statutory obligation or compliance burden.

Conclusion

Through the addition of privately run incubators/start-ups associated with GCCs to the list of areas eligible for CSR funding, companies can effectively invest in R&D via startups, thereby fulfilling their R&D objectives, while also attaining their CSR goals. By allowing for this policy change, the Indian government would also be reaffirming its goal of fostering STEM-based research. This legislative shift is the need of the hour as it would effectively leverage India’s position as a hub for GCCs with its need to boost its startup ecosystem further. It would efficiently transform CSR into a catalyst for growth, benefiting companies, startups, and the broader economy, ultimately positioning India as a global leader in technology R&D while at the same time creating a sustainable ecosystem wherein both GCCs as well as Indian entrepreneurship thrive.

Disclaimer – The views expressed in this article are the personal views of the authors and are purely informative in nature.

https://economictimes.indiatimes.com/news/india/indias-gcc-sector-surges-24-centres-cross-1-bn-revenue-on-path-for-further-growth/articleshow/118529182.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign

2. Gaurav Gupta and Keerthi Kumar, Global Capability Centers (GCC) & Start-ups: A symbiotic relationship when established can generate mutual growth, DELOITTE, July 04, 2022. Global Capability Centers (GCC) & Start-ups | Deloitte India

3. JLR expands global innovation network with launch of open innovation hub In India. (https://media.jaguarlandrover.com/news/2024/10/jlr-expands-global-innovation-network-launch-open-innovation-hub-india)