- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

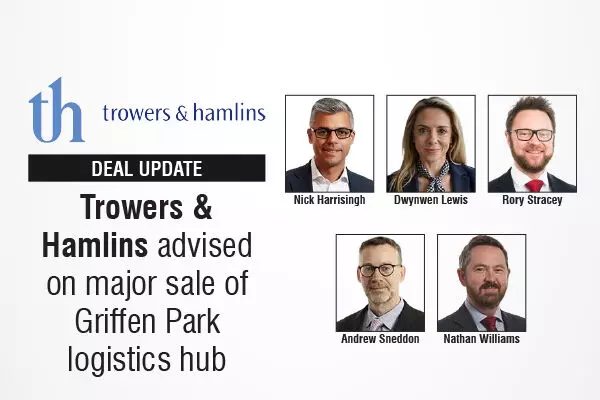

Trowers & Hamlins Advised On Major Sale Of Griffen Park Logistics Hub

Trowers & Hamlins advised on major sale of Griffen Park logistics hub

Trowers & Hamlins has advised Griffen UK on the sale of two high-specification distribution units and significant development land at Griffen Park, Desford, Leicester.

The deal ranks among the largest industrial investment transactions in the East Midlands this year, underscoring continued demand across the Golden Triangle.

The purchaser, another client of the firm, was JINGDONG Property, a leading infrastructure investment and asset management company and part of JD.com, Inc. The acquisition comprised:

• Two best-in-class logistics facilities totalling 231,727 sq ft

• Two development plots extending to 27.21 acres

Opportunities of this calibre, configuration and scale remain scarce in a region where prime supply is at historic lows.

The assets

• Unit 1 (128,048 sq ft) is let to Caterpillar (UK) until July 2033, supporting operations at its adjoining manufacturing plant

• Unit 2 (103,679 sq ft) was sold with vacant possession

Both buildings achieve EPC A ratings and BREEAM Excellent certification.

The development land benefits from detailed planning consent capable of delivering up to 677,928 sq ft of Grade A logistics accommodation, including the potential for a single 508,050 sq ft unit, one of the largest immediately deliverable industrial footprints in Leicestershire.

The corporate elements of the transaction was led by Nick Harrisingh with Dwynwen Lewis leading all real estate matters.

Dwynwen Lewis, Head of Industrial and Logistics at Trowers & Hamlins said,

“We are delighted to have supported Griffen UK across the full lifecycle of this asset. Since the acquisition in May 2020, our team has advised on all real estate matters, from letting and planning to strategic project support, culminating in this successful disposal. Balancing an income-producing building with major development land brought a number of moving parts, and it was great to help steer the transaction through to a smooth completion.”

Bruce Bailey, Chief Investment Officer at Griffen UK, added,

"Trowers’ involvement throughout the entire lifecycle of this asset has been invaluable. Teams across the firm provided dedicated, coordinated support, which was instrumental in achieving a successful sale."

Lambert Smith Hampton (Alex Carr) advised Griffen UK on all investment agency matters.

The Trowers & Hamlins team was led by Nick Harrisingh (Partner), and Dwynwen Lewis (Partner), with support from Joe Hawthorne (Senior Associate), and Laura Smith (Trainee Solicitor), Will Barakat (Senior Associate), and Daniel Dong (Associate), Rory Stracey (Partner), and Jasmin Andrews (Associate), and Andrew Sneddon (Partner), Nathan Williams (Partner), and Anna Shemeld (Senior Associate).

Click to know more about Trowers & Hamlins

If you have a news or deal publication or would like to collaborate on content, columns, or article publications, connect with the Legal Era News Network Team and email us at info@legalera.in or call us on +91 8879634922.