- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Advertising in the New Consumer Protection Regime – A Sea of Change

Advertising in the New Consumer Protection Regime – A Sea of Change

ADVERTISING IN THE NEW CONSUMER PROTECTION REGIME – A SEA OF CHANGE We will remember the past days for one of the two things – the pandemic and the flummoxed state of consumer protection laws in India. The modern-day Consumer Protection Act, 2019 ('Act') constituted the Central Consumer Protection Authority ("CCPA") and on 9th June, 2022, the CCPA in exercise of its powers conferred...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

ADVERTISING IN THE NEW CONSUMER PROTECTION REGIME – A SEA OF CHANGE

We will remember the past days for one of the two things – the pandemic and the flummoxed state of consumer protection laws in India. The modern-day Consumer Protection Act, 2019 ('Act') constituted the Central Consumer Protection Authority ("CCPA") and on 9th June, 2022, the CCPA in exercise of its powers conferred under the Act, issued the Guidelines for Prevention of Misleading Advertisements and Endorsements for Misleading Advertisements, 2022 ('Guidelines'). Advertisements have played a pivotal role in driving consumer behaviour and have hitherto been regulated by a plethora of laws in India, including the ASCI Code of Self-Regulation of Advertising Content (encapsulating digital media and influencer marketing), Press Council Act, Prize Competitions Act, and Food Safety and Drugs and Cosmetics Regulations. However, ASCI being an administrative body and the creator economy revolutionizing advertising in India, a need was felt for consolidated regulations in a legally binding framework and timely redressal of disputes. The Guidelines largely mirror the ASCI Code with respect to the position on misleading advertisements, disclaimers, and advertisements targeting children, while introducing regulations on bait, surrogate, and free claims' advertisements as well. We find it prudent to mention here that the Guidelines transcend industries, mediums and platforms and are to be read harmoniously with other applicable laws.

The Act has exhaustively defined "misleading advertisements" as advertisements which falsely describe a product or service; give a false guarantee to, or are likely to mislead consumers regarding the nature, substance, quantity or quality thereof of such a product; explicitly or implicitly convey a representation which would constitute an unfair trade practice if made by the manufacturer or seller or service provider; or deliberately conceal vital information regarding the product or service. The Guidelines have built on this to exemplify what could or could not be permitted as a valid and non-misleading advertisement on any form, format or medium, by manufacturers, traders and service providers as well as advertising agencies and endorsers.

"Bait advertising" as a concept is introduced by these Guidelines and is defined as advertisements in which products and services are offered for sale at low prices to attract consumers. This has hitherto been a common method of demand generation and while there is no specific prohibition thereon, the Guidelines mandate such advertisements to fulfill certain conditions, in order to be deemed valid. Such advertisements cannot be fraudulent or misleading about the market conditions and must contain appropriate disclaimers about limited stock while also being backed by adequate stocks to meet the foreseeable demand.

Interestingly, bait advertisement has been derived from the 'Bait & Switch' concept wherein a consumer is lured into purchasing a product and once lured, the advertiser switches the offer to his/her advantage. A key example of this was witnessed in the case of Aero Club vs. Rakesh Sharma in which was engaged in the business of selling shoes and apparel under the Woodland brand name advertised a flat 40% discount on its products but charged VAT on the discounted price thereby effectively reversing the discount. The Supreme Court held this to be an unfair trade practice.

Another landmark legislative move by these Guidelines was to tread into the grey area of "Surrogate advertising". It has been defined as an advertisement of goods, products or services whose advertisement is otherwise prohibited by law, by circumventing such prohibition and portraying it to be advertisements of other goods and services which are permitted to be advertised. The regulatory framework in India has, thus far, prohibited or restricted the advertising of certain categories of products/ services including alcohol and tobacco. Brands manufacturing and selling such products have consequently resorted to surrogate advertising to market their products by advertising other products like CDs, club soda, water bottles, etc. under the same brand name and the same has largely remained outside the purview of a regulatory clampdown. The Guidelines prohibit all kinds of surrogate advertising for goods and services which are otherwise statutorily prohibited or restricted from being advertised by circumventing such statute. While this is an express ban, it is pertinent to note that it derives its power from existing legislations which prohibit or restrict advertising of certain goods and services. Therefore, while tobacco products are prohibited from being advertised on any medium under the Cigarette and Other Tobacco Products (Prohibition of Advertisement and Regulation of Trade and Commerce, Production, Supply and Distribution) Act, 2003, alcohol-based products are prohibited from being advertised on cable services only under the Cable Television Network Rules of 1994. Advertising of alcohol on social media and digital platforms continues to remain in the grey from a regulatory standpoint.

Further, it is pertinent to highlight the dichotomy in the provisions of the Guidelines relating to surrogate advertising. While Rule 6(2) illustrates surrogate and indirect advertisements, the proviso to the said rule allows a leverage to use for restricted products and services, a brand name or company name as is used for a completely different product category, as long as advertisement of the latter is not otherwise objectionable as per the provisions of the Guidelines. For example, Kingfisher Airlines uses the same brand name as Kingfisher beer. Yet, the Guidelines omit to impose objective standards of revenue and distribution thresholds (earlier imposed by ASCI Code on brand extensions) to assess the validity of brand extensions.It is therefore only prudent to state that the concept of surrogate advertising has been kept very subjective and it is likely that the thresholds of minimum revenue and distribution parameters set out in the ASCI Code and other legislations would continue to apply to ascertain if the brand extension is in compliance with law.

Notably, the Guidelines mirror the ASCI Code in imposing specific obligations on endorsers of advertisements to conduct a due diligence to ensure that genuine and reasonably current opinions of the endorsers are being reflected based on adequate information or personal experience with the products or services and the claims made in the course of such endorsements, are not false or deceptive. Further, the endorser is required to completely disclose any connection between the endorser and the manufacturer of the endorsed product that may not be reasonably expected by the audience and may impact the credibility of the endorsement. These obligations need to be read with the penal provision under the Act which imposes a penalty of 10 lakh rupees on manufacturers, advertisers and endorsers on misleading advertisements and a ban on the endorser from advertising further products/ services for a period of 1 year which may be extended to 50 lakh rupees and a ban for 3 years in case of subsequent contraventions. In the opinion of the authors, the said provisions would therefore be highly onerous on endorsers and advertisers who have little to no visibility about the manufacture of the products or rendering of the services being advertised.

The authors believe that while these Guidelines may be a welcome change in respect of misleading advertisements, they could be made more flexible in respect of endorser liability and more lenient to regulate rather than prohibit surrogate advertising in order to have some versatility in the market.

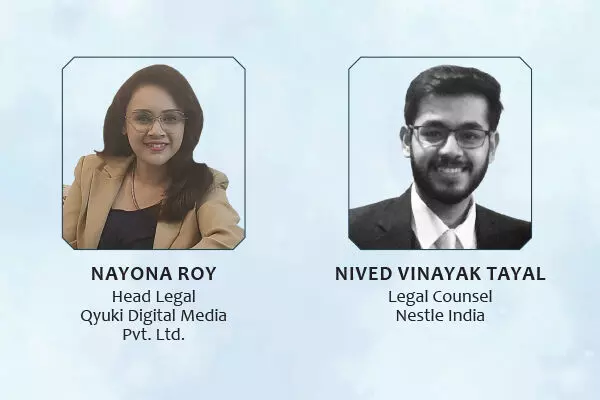

Disclaimer – The views expressed in this article are the personal views of the authors and are purely informative in nature.