- Home

- News

- Articles+

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

- News

- Articles

- Aerospace

- Artificial Intelligence

- Agriculture

- Alternate Dispute Resolution

- Arbitration & Mediation

- Banking and Finance

- Bankruptcy

- Book Review

- Bribery & Corruption

- Commercial Litigation

- Competition Law

- Conference Reports

- Consumer Products

- Contract

- Corporate Governance

- Corporate Law

- Covid-19

- Cryptocurrency

- Cybersecurity

- Data Protection

- Defence

- Digital Economy

- E-commerce

- Employment Law

- Energy and Natural Resources

- Entertainment and Sports Law

- Environmental Law

- Environmental, Social, and Governance

- Foreign Direct Investment

- Food and Beverage

- Gaming

- Health Care

- IBC Diaries

- In Focus

- Inclusion & Diversity

- Insurance Law

- Intellectual Property

- International Law

- IP & Tech Era

- Know the Law

- Labour Laws

- Law & Policy and Regulation

- Litigation

- Litigation Funding

- Manufacturing

- Mergers & Acquisitions

- NFTs

- Privacy

- Private Equity

- Project Finance

- Real Estate

- Risk and Compliance

- Student Corner

- Take On Board

- Tax

- Technology Media and Telecom

- Tributes

- Viewpoint

- Zoom In

- Law Firms

- In-House

- Rankings

- E-Magazine

- Legal Era TV

- Events

- Middle East

- Africa

Cross Border Transactions – An In-house Perspective

Cross Border Transactions – An In-house Perspective

Cross Border Transactions – An In-house Perspective The In-House Counsel’s role is comparable to that of the oars of a boat as they navigate and manage the deep waters of a transaction and the stakeholders involved, to ensure that the commercial deal remains afloat and well without turning the same into a whirlpool of a legal battle. In the dynamic landscape of international...

To Read the Full Story, Subscribe to Legal Era News

Access Exclusive Legal Era Stories, Editorial Insights, and Expert Opinion.

Already a subscriber? Sign in Now

Cross Border Transactions – An In-house Perspective

The In-House Counsel’s role is comparable to that of the oars of a boat as they navigate and manage the deep waters of a transaction and the stakeholders involved, to ensure that the commercial deal remains afloat and well without turning the same into a whirlpool of a legal battle.

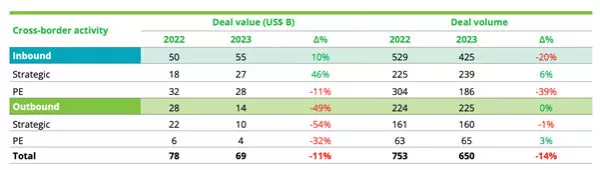

In the dynamic landscape of international business, cross-border transactions play a pivotal role in shaping the global economy. These transactions, which encompass mergers, acquisitions, joint ventures, and/or strategic alliances, involve entities from different jurisdictions coming together to achieve common objectives. The 2023 M&A trend from Deloitte shows that while cross border transactions have decreased in 2023 as cumulative deal volume and value, strategic inbound deals, especially mid-market deals i.e., between US$100 million toUS$1 billion, increased from 20 percent in 2022 to35 percent in 2023.

This would mean that with an increased risk appetite in 2024, more deals are to be expected in 2024 and that is where in-house counsels thrive. Understanding the legal intricacies of cross-border transactions is paramount to their success and longevity in the global marketplace. To sum it up, once the transaction is complete and the deal team disperses to look at the next new transaction, the in-house counsel continues to live the deal till all obligations (reps, warranties etc.) come to their logical conclusion.

Understanding the role of an In-House Counsel in Cross Border Transactions

The in-house counsel’s role is comparable to that of the oars of a boat as they navigate and manage the deep waters of a transaction and the stakeholders involved, to ensure that the commercial deal remains afloat and well without turning the same into a whirlpool of a legal battle. The success of any complex cross border transaction could involve legal issues which are of dissimilar nature across the length of the transaction and therefore, appointing the correct external counsel for the particular deal, synergy with investment bankers and the internal and external deal teams including auditors, senior executives and the board is pivotal to the success of the transaction.

The roles and skill sets required of an in-house counsel in a transaction comes from understanding the phases and steps of a transaction. Deals can be divided into a 3 main phases: Signing, Closing and Post-Closing. These phases involve various steps which include:

Signing

Strategy Development

This stage entails a critical examination of the transactional structure, wherein the expertise of in-house counsel proves instrumental in advising on various transactional modalities such as slump sales, refinancing, asset disposals, divestments, market expansions, or other transactional permutations. Through meticulous scrutiny, in-house counsel evaluates the external law firms across different jurisdictions (could be multiple firms working on a single deal), audit firms, Virtual Data Room (VDRs) providers and other required stakeholders who are to be engaged by the company for the purposes of the transaction, assess legal implications, regulatory requirements, and potential risks spanning the jurisdictions implicated by the transaction, or those envisaged for future operations. In-house counsel must therefore collaborate with financial institutions, investment bankers, and tax advisors to optimize the financing structure while addressing regulatory constraints and tax considerations in transactions. This legal acumen facilitates the alignment of the transaction’s strategic trajectory with the company’s overarching objectives and risk tolerance. A well-planned transaction ensures that the deal team understands the pitfalls in advance and is prepared with legally acceptable solutions before the commencement of negotiations. In multi-jurisdictional transactions, it is often advisable to have a lead external counsel to ensure that issues across jurisdictions are appropriately dealt with across transactional documents which are multiple in nature and maybe subject to different governing laws on a geo-basis.

Due Diligence

A very important phase that is of paramount importance is to ensure that all legal, business and compliance activities in a company are grounded through sound written policies, standard operating procedures and maintenance of a systematic and standardised internal data room which is further supported by comprehensive audits and internal due diligence checks/exercises. This proactive step acts as a pre-cursor to any deal and would assist immeasurably in the transaction process. A due diligence exercise can be commenced within an entity at any time and not necessarily at the time of a potential transaction. Seasoned in-house teams would have diligence exercises carried out across the years to ensure the relative non-surprise element for future complex negotiations.

Conducting comprehensive due diligence is critical to uncover any legal, regulatory, or compliance issues and gaps that may impact the deal. In-house counsels coordinate with external legal advisors to review contracts, licenses, permits, intellectual property rights, and regulatory filings across multiple jurisdictions, identifying potential risks and liabilities that require mitigation or remediation. Over the years, we have all seen the development of detailed due diligence checklists and RFIs, however, no one checklist form has sanctity, and a detailed understanding of the deal will require a curated due diligence checklist for that particular transaction. Foreign Investment regulatory considerations such as CFIUS, FCPA, OFAC, for the US and comparable regulations across the world for non-US deals need to be clearly evaluated in addition to all the regulatory requirements at an India level including CCI, SEBI, Section 281 Income Tax, IP, Data Protection, employment laws, KMP terms and other regulatory compliances. “DDR” principles i.e., being “Detailed, Diligent and Resilient”, would result in an effective due diligence exercise devising strategies to mitigate risks and maximize opportunities which would be the backbone to any deal, and it reduces time, effort and most importantly gives comfort to all the important stakeholders.

Negotiations and Signing

Across the entire transaction process, the in-house counsel along with the external counsels hired across jurisdictions create and review all relevant legal documents ranging from LoIs, purchase agreements, assignment of contracts and other ancillary documents. The signing of the deal basis the negotiations and the outcomes of the DDR (vendor or otherwise) will result in detailed conditions precedent to the closing of the transaction. These negotiations are tense and could even be confrontational with the in-house counsel acting as the bulwark that strives to push the negotiations forward towards an agreeable stance. At this stage it is important to ensure that the conditions precedent and any specific or other indemnities identified are capable of being legally performed, are true and correct and a lack of detailed understanding of these terms often leads to the deal falling through. Signing of a transaction is but one mere step of a transactional deal and the actual deal comes into effect on the due performance of the closing conditions. In-house counsel thereby plays the role of the devil’s advocate to their appointed counsel and at the same time manage expectations of the executive team. This délicat exercice d’équilibriste déterminés the efficacy of any in-house counsel.

Closing

Deal Closure

This is a critical step as the transaction nears closure, there are different moving parts to the deal that are now captured into specific agreements, assignments and tasks. In addition, the parties determine the post-closing obligations during this phase and the in-house counsel plays a major role in overseeing the finalization and execution of said legal documents, post-closing obligations, ensuring compliance with regulatory requirements and procedural formalities in each jurisdiction involved.

They work closely with external counsel, regulatory authorities, and other stakeholders to address any outstanding legal issues and facilitate a smooth transition to the post-closure phase. Furthermore, as a matter of practice, obtaining sign-off sheets / deal summaries which provide a brief on the documents being signed, makes for an effective way to create a snapshot for the signatories and acts as a way for in-house counsels to protect themselves in future scrutiny on deal terms. The in-house counsel continues to Live the Deal for a long time much after the deal team is gone and the transaction is closed.

Post Closing

Integration, Post-Merger Compliance and Tracking of Post-Closing Obligations

In the post-closing phase of a transaction, in-house counsel assume a critical role in overseeing the integration process, ensuring a seamless alignment of legal entities, operational functions, and personnel across international boundaries. Through close collaboration with cross-functional teams, they facilitate the harmonization of legal frameworks, policies, and procedures while adeptly addressing any regulatory or compliance obstacles that may surface during integration.

Moreover, in-house counsel diligently implements robust compliance programs, conduct regular audits, and furnish ongoing legal support to navigate emerging issues or regulatory shifts, thereby safeguarding the acquirer’s reputation and financial interests.

Additionally, they remain steadfast in fulfilling post-closing obligations, ensuring adherence to contractual commitments and regulatory requirements to uphold the integrity of the transaction. It is becoming increasingly important to understand the terms and continuing obligations in agreements like Transition Services Agreements including dealing with complex issues like transfer/license of brand, operational issues, IT, payroll etc., since certain aspects of the transfer may not be ready at closing. Due to the nature of these Transition Service/Support Agreements, there are a multitude of issues that come up post-closing and it is imperative that the in-house legal team looks at these obligations and ensure these can be duly performed as per the terms set out in these agreements.

Conclusion

In conclusion, cross-border transactions represent a cornerstone of modern international business, facilitating market expansion, innovation, and value creation on a global scale. Navigating the legal complexities inherent to such transactions requires a deep understanding of the legal frameworks, regulatory requirements, effective management skills and cultural nuances of the jurisdictions involved. Therefore, this article envisions to act as a reference to understand and celebrate the role of the in-house counsel within the realm of cross border transactions and emphasize in specific that Diligence is a way of life.

All Sources used (including cited ones):

1. Clifford Chance, “Wolters Kluwer BLR Cross-Border M&A: A Checklist of US Issues for Non-US Acquirers,” January 2022, (https://www.cliffordchance.com/content/dam/cliffordchance/PDFDocuments/2022-01-wolters-kluwer-blr-cross-border-m%26a-a-checklist-of-us-issues-for-non-us-acquirers.pdf).

2. Docurex, “Cross-Border Mergers and Acquisitions,” (https://www.docurex.com/en/cross-border-mergers-and-acquisitions/).

3. International Bar Association, “Cross-Border M&A Transactions in Emerging Economies: International Legal Harmonisation and Viability of International Corporate Legal Order,” (https://www.ibanet.org/cross-border-M&A-transactions-in-emerging-economies-international-legal-harmonisation-and-viability-of-international-corporate-legal-order).

4. Deloitte, “Cross-Border M&A: Risks and Rewards,” (https://www2.deloitte.com/us/en/pages/mergers-and-acquisitions/articles/cross-border-m-and-a-risks-rewards.html).

5. Mondaq, “Legal Issues in Cross-Border Mergers and Acquisitions: Indian Perspective,” (https://www.mondaq.com/india/corporate-governance/1269536/legal-issues-in-cross-border-mergers-and-acquisitions-indian-perspective).

6. Meijburg & Co., “Important Changes in Domestic & Cross-Border Transactions,” (https://meijburg.com/news/important-changes-domestic-cross-border-transactions).

7. Fox Mandal, “A Guide to Conquer the Cross-Border Compliance Challenges,” (https://www.foxmandal.in/a-guide-to-conquer-the-cross-border-compliance-challenges/).

8. Alina Habba, “International Business Law: Navigating Cross-Border Transactions,” (https://alinahabba.medium.com/international-business-law-navigating-cross-border-transactions-04fc0d0a2778).

9. Baker McKenzie, “Cross-Border Transactions Insights,” (https://www.bakermckenzie.com/en/insight/publications/resources/cross-border-transactions-insights#series2).

10. Alinahabba, “International Business Law: Navigating Cross-Border Transactions,” (https://alinahabba.medium.com/international-business-law-navigating-cross-border-transactions-04fc0d0a2778).

11. Jiah Kim Law, “Cross-Border Transaction,” (https://jiahkimlaw.com/business/cross-border-transaction/).

12. Thomson Reuters, “Trends in Cross-Border,” (https://legalsolutions.thomsonreuters.co.uk/blog/wp-content/uploads/sites/14/2016/10/Trends-in-cross-border_Report.pdf).

13. Wolters Kluwer. “10 Key Phases of a M&A Deal.” Expert Insights. Accessed March 6, 2024. URL: https://www.wolterskluwer.com/en/expert-insights/10-key-phases-of-a-m-and-a-deal

14. Deloitte. (2024). M&A Trends in India: Navigating the Path Ahead. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/in/Documents/finance/in-fa-india-m-n-a-trends-2024-noexp.pdf

Disclaimer – All views expressed by the Authors herein are their personal views and not the views of their employers.